So how did Hong Kong go from a sleepy fucking fishing village into a global metropolis? How did the real estate trade go from shady cha chaan teng deals to become such a well-regulated industry? This section delves into the history of the real estate trade in Hong Kong.

1945 -1952 / After the Japanese Occupation

Of course it’s the Japanese coming in to fuck shit up first. After occupying Hong Kong, mad people fled yo. The population dropped from 1.6 million to 500,000. The problem for the real estate trade here? No people = no demand for homes. Real estate trade = fucked.

After 1945, the population slowly flooded back, bringing with it skilled labor and more importantly, capital from the Mainland. People occupying units in multi-story buildings used to pay rent directly to the Landowner. Soon, individual units started to go on sale. Incomplete units in buildings started to sell too, with the buyers paying in instalment til completion.

Then 1952 rolled around and the Korean War fucked shit up all over again. Trade embargo with the Mainland meant people gettin fucked.

How does this relate to the Trade?

- In the 1950s and 1960s, most estate agents were hustlers operating one-man firms which had no staff or office. Business was mainly carried out in restaurants in where agents met to exchange information and negotiate property transactions.

- Many of the agreements they drafted were shitty and contradictory. Clients were referred to solicitors to prepare the formal documentation necessary for the sale and purchase of land. Most sales were for building sites and buildings rather than units.

- In 1966, the building of Mei Foo Sun Chuen, the first major housing estate in Hong Kong, changed the picture. Small estate agency companies began to emerge in Mei Foo, specialising in the sale of uncompleted units in this housing estate.

1953 – 1970 / Rise of Manufacturing

Fucking depressing just looking at it, don’t you think?

Trade embargo lifted. Demand restored. Factories goin up to satisfy it. People and capital kept flowing in from the Mainland and South-East Asia. This led to a glut in property, with too much supply and the people with not enough money to buy. In 1966, Mei Foo Sun Chuen was completed and thus began an era of multi-storey residential buildings as a part of large estates.

How does this relate to the Trade?

- Them estate agents spread like the plague in the 1970s with the increase in housing estates and the development of new towns in the New Territories. Agents set up retail shops and several firms opened branch offices.

1971 – 1984 / The Golden Years

1973 – Stock market crash means property market slump. Externals like the Middle East oil crisis also affected markets.

1979 – Mainland adopts open-door policy. Hong Kong industries move to Pearl River Delta/Guangdong to take advantage of cheap labor. HK industrialists get richer. Buys more shit.

1981 – Property prices were at a record high due to the strong demand for housing and speculation. Interest rates increase and these motherfuckers get nervous about HK being handed back to China

How does this relate to the Trade?

- The 1980s saw many more playas in the game. The commission system was introduced in the early 1980s giving homies a cut. There were a few large playas, each of which had more than 10 branches. They dealt with all parts of the market, comprising retail, commercial, industrial, and residential properties. Towards the end of the 1980s, agencies began to computerise their shit.

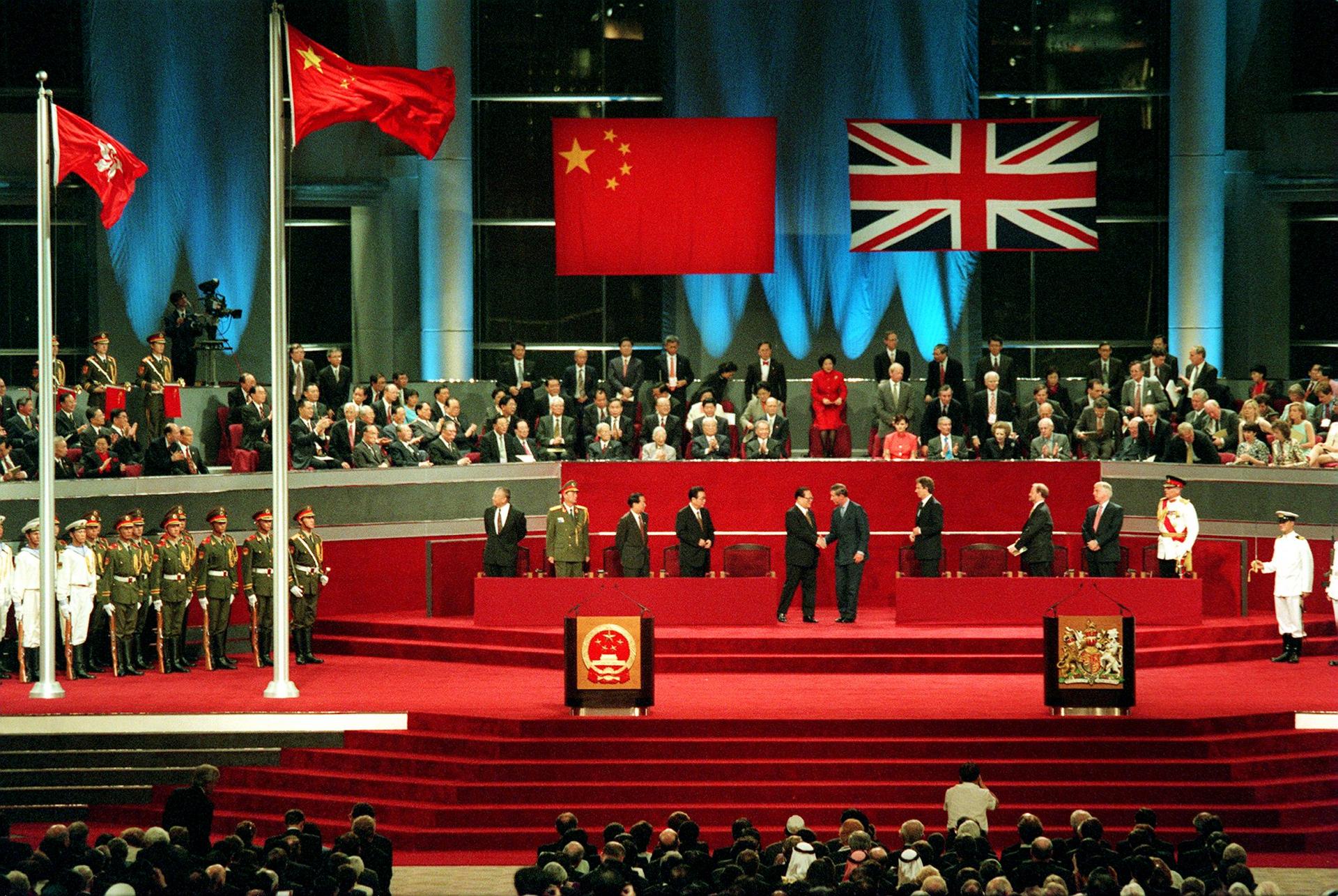

1985-1997 / Sino-British Joint Declaration

Investors get less jumpy about HK being handed back after this declaration. Ensures HK’s autonomy and the rules for the handover.

How does this relate to the Trade?

- The early 1990s saw phenomenal growth in the trade, with the largest playas having branches in almost every housing estate in Hong Kong. Of these, the two largest had more than 200 branches each. One of these firms was listed on the Stock Exchange of Hong Kong Limited in 1995.

- The financial crisis of 1997-8 resulted in a cleansing of the field. Less efficient companies were closed or consolidated. The trade was sustained by the sale of uncompleted units by developers, who engaged playas to market and procure buyers for their properties. They paid commission for agents’ services.

- In 1997, the Estate Agent Ordinance (EAO) was enacted and the Authority established. This brought the first formal regulation of the trade. Changes in the trade meant that a licensee must:

- Get a licence .

- Use standard forms when acting in the sale of residential property.

- Play by the rules of the EAO.

- Get punished if you don’t

Post 1997

As an international financial centre, Hong Kong’s economic condition and property market are highly sensitive to internal policy and international monetary policy.

External factors:

- For example, after the world-wide financial tsunami in 2008, the American government launched various monetary policies. As a result there was a ton of cash and no where to put it. To resist inflation, many investors put their money into the property market of Hong Kong, making prices fucking skyrocket. Rich corrupt Chinamen pouring their money into Hong Kong also ups the price.

Internal factors:

- These include Hong Kong’s economic cycles, the housing policies and property market measures launched by the HKSAR government, etc.

- Most of the property market measures adopted are intended to control property prices or suppress speculation activities. For example, the special stamp duty, buyer’s stamp duty, and double stamp duty introduced by the Government in 2010 and 2013 respectively were to bring prices down.

- Epidemics like SARS also will cause the property market to be affected.

How does this relate to the Trade?

- Since the intro of the EAO, the practice of the estate agency trade is being regulated and the standard of the playas has improved. In 2005, the Authority launched a (boring) voluntary continuing professional development scheme encouraging licensees to enhance their professional knowledge and competence through continuous learning.

THE RELATIONSHIP BETWEEN THE REAL ESTATE AGENCY TRADE AND OTHER PROFESSIONS AND SECTORS

Government – These are the big homies that control the field. You’re gonna find most of the information you need about a property from the Land Registry. You will use the Land Registry’s Integrated Registration Information System Online Services, aka IRIS to perform your land search and obtain the necessary documents and information. The search will show the ownership of the land, registered incumbrances (any defects or outstanding charges against the property/land) and any contracts such as leases for a term in excess of three years. A land registry search is the starting point and is an essential source of info.

- Other property information (e.g. saleable area of residential properties, user and completion year of properties) can be obtained online from the Rating and Valuation Department, a government department responsible for collecting government rent and rates, through the Property Information Online system. You will find that Form CR 109 which is used to provide details of domestic tenancy agreements is also lodged with this department.

- Copies of occupation permits can be obtained from the Buildings Department.

- Information about land auctions, tenders and other disposals of properties by the Government can be obtained from the Lands Department.

- The removal of alienation restrictions for the transfer of units under the Home Ownership Scheme and the Tenant Purchase Scheme is administered by the Housing Department. (not important)

- Information about limited companies can be obtained from the Companies Registry.

- Licensees may from time to time have to attend to stamping of tenancy agreements, agreements for sale and purchase as well as assignments for their clients at the Stamp Office of the Inland Revenue Department.

- The Authority, a statutory body and the regulatory body for the agency trade.

Solicitors aka The Devil Incarnate – The SPA, assignment, and mortgage are generally prepared by solicitors acting for each party in a transaction. Licensees should also advise their clients to seek legal advice from solicitors. This may mean that a licensee will have to liaise with solicitors at various stages of a property transaction. Unfortunately, most solicitors are money hungry, thirsty fuckers. Take care.

Banks aka Money Grubbers – Most purchasers will require mortgage finance for the purchase of a property. Hopefully you’re a baller motherfucker who doesn’t need it. The majority of loans are provided by banks. In your role, you will have to explain mortgages and usually find a mortgage for a client by introducing them to banks. Unfortunately, most banks are money hungry, thirsty fuckers. Take care.

Property Developers – Prior to the financial crisis of the late 1990s, developers usually looked after the sale of their own properties. After the financial crisis, it became common practice for developers to appoint estate agents to market uncompleted units, paying substantial commission (sometimes equivalent to more than 2% of the sale price) for their services. This made developers important clients for estate agents. Unfortunately, most developers are money hungry, thirsty fuckers. Take care.

Building and Construction Sector – Builders and contractors build properties; licensees sell them.

Property Management Sector – The building manager of a property can give information relating to arrears of management fees, costs of renovation work for a building, the existence of any building order affecting a building, and other relevant matters. The quality of property management affects the value of properties, and therefore purchasers generally look for properties with good management. For these and other reasons, property management and the personnel involved in property management are relevant to the estate agency trade.

Sale of First-hand Residential Properties Authority (SRPA) – To further enhance the transparency and fairness of the sales of first-hand residential properties, the Residential Properties (First-hand Sales) Ordinance (RPFSO) came into full effect on 29 April 2013. The objectives of the RPFSO are to create a clear, fair, balanced, practical and efficient mechanism to regulate the sales of first-hand residential properties, and to protect the interest of residential property buyers through enhancing transparency and making contravention of the mandatory requirements criminal offences. The RPFSO also provides a level playing field for vendors of first-hand residential properties. The SRPA is set up to ensure that the RPSFO is implemented effectively.

STATISTICS ON SUPPLY AND DEMAND IN THE PROPERTY MARKET

Each year the Rating and Valuation Department publishes the Hong Kong Property Review, which reviews the property market for the previous year. Stats on completion, take-up, vacancies, prices and rent. It also contains forecast statistics on properties scheduled for completion, based on information obtained from developers and project architects, and verified by development progress inspections as well as enquiries made at the beginning of the forecast period.

AND THAT CONCLUDES HALF OF PART 1. IN THE NEXT POST, WE’LL DISCUSS HOW WE BECOME PLAYAS IN THE GAME, THE RULES AND REGULATIONS, THE HOW HOW TO GET THAT PAPER.

TAKE A BREAK.